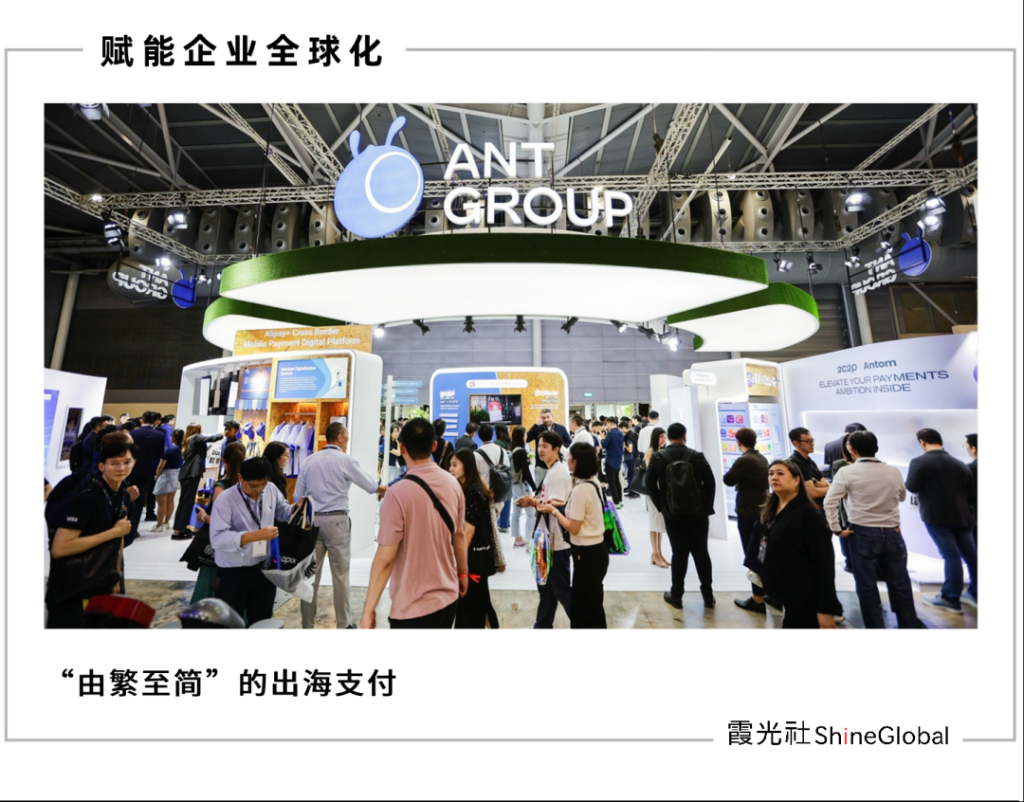

On 15 November, the Singapore FinTech Festival (SFF), a global FinTech event, opened.

This year’s overseas payment solutions and enterprise financial services from China have received the attention of many Southeast Asian officials and merchants both inside and outside the venue. For example, Ant Group’s booth has ushered in frequent stops and hands-on experience by Singapore President Sang Daman and Singapore Deputy Prime Minister Ong Swee Keat.

Ant Group’s WorldFirst cross-border SME financial service platform also announced for the first time that it would expand its service scope to Southeast Asia, helping local SMEs to complete cross-border direct sourcing conveniently and participate in global trade.

SMEs played a pivotal role in the South-East Asian economy. In Singapore, small and medium-sized enterprises (SMEs) with an annual turnover of up to S$100 million and 200 employees account for 99 per cent of the total number of enterprises, employ more than 65 per cent of the total number of workers in the society, and contribute close to 50 per cent of the annual economic growth. A survey conducted by the United Daily News in 2022 revealed that 81 per cent of local SMEs engaged in online business plan to or have already engaged in cross-border trade to keep up with the global trend of growing e-commerce. Centred on Singapore, Southeast Asia has also become a must for many Chinese small and medium-sized exporters in their efforts to diversify.