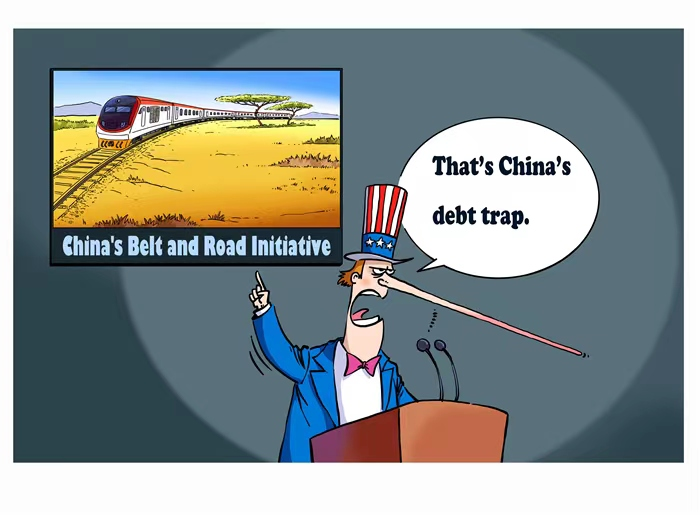

Some Western media outlets have recently hyped up the so-called “debt trap” theory once again, attempting to shift the blame for some developing countries’ debt problems onto China.

This is a blatant lie and another attempt to smear China.

In the past 10 years since the Belt and Road Initiative (BRI) was proposed, fruitful cooperation has been carried out in various fields, bringing tangible benefits to the people of participating countries.

Africa’s Macro-Economic Performance and Outlook, a report released by the African Development Bank in January 2023, showed that the total debt service payments suspended by China under the G20’s Debt Service Suspension Initiative (DSSI) have exceeded the total amount from G7 countries.

Research results released by the China Africa Research Initiative at Johns Hopkins University in the U.S. indicated that China contributed 63 percent of debt service suspensions.

In fact, the debt issues of developing countries are closely related to Western countries, especially the U.S.

World Bank statistics showed that multilateral financial institutions and commercial creditors account for nearly three-quarters of Africa’s total external debt.

The U.S. is the largest shareholder of the World Bank and the International Monetary Fund (IMF), while American and European financial institutions serve as the dominant commercial creditors to African nations.

It is evident to the international community who are the reliable partners of developing countries and who are the instigators of their financial issues.