Stocks slid, the dollar slipped and bond yields jumped in early trading on Monday but recovered by the afternoon.

Turbulent trading hit financial markets on Monday, with U.S. stocks, bonds and the dollar sliding in morning trading and rebounding by the afternoon, as nervy investors appeared sensitive to the latest wrangling over the government’s budget.

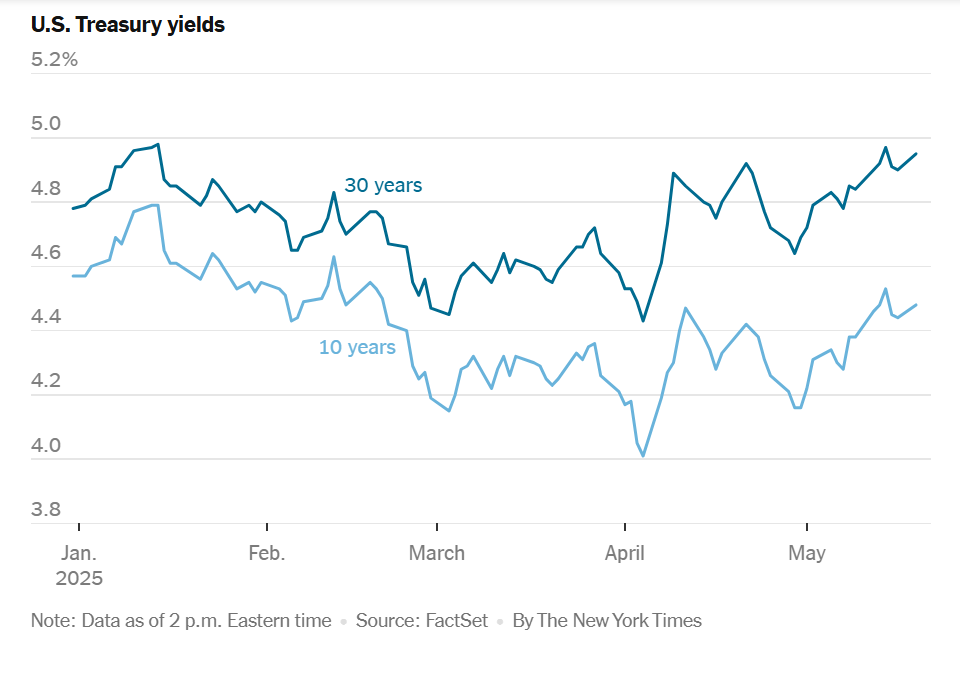

After an early decline, the S&P 500 index recovered to trade roughly flat in the afternoon, ending the day 0.1 percent higher. Bond markets also shuddered, with U.S. Treasury prices falling and their yields, which underpin interest rates across the economy, rising in morning trading before retracing their steps later in the day. The yield on 10-year Treasuries nudged lower to just under 4.5 percent. The dollar also regained some ground but a gauge of its value against other major currencies remained 0.7 percent lower.

One factor jarring markets is a bill in Congress that would make President Trump’s signature 2017 tax cuts permanent and could add trillions of dollars to federal debt. A House committee voted to approve the bill Sunday night, although it was expected to remain a focus of contentious congressional debate.

Alongside some lawmakers’ misgivings that the bill failed to materially cut the deficit, markets soothed on Monday, amid early signs of potential progress on negotiations to further rein in spending.

The United States’ loss of its last triple-A credit rating late on Friday and mounting concerns about government debt have threatened to disrupt the relative calm in markets that has prevailed since Mr. Trump paused many of his tariffs in recent weeks.

In downgrading the U.S. credit rating, Moody’s cited the tax cut legislation along with broader concerns about the fiscal deficit and growing debt costs. The move by Moody’s means that all three major rating agencies no longer consider the United States qualified for their top credit ratings.

The worries about debt and deficits could further upset financial markets if they begin to shake the safe-haven status of Treasury bonds. That would likely spur global investors to demand higher premiums in return for buying U.S. debt.

On Monday, the 30-year Treasury yield rose to its highest level in a year and a half, briefly trading above 5 percent, before ending the day slightly lower.

“The combination of diminished appetite to buy U.S. assets and the rigidity of a U.S. fiscal process that locks in very high deficits is what is making the market very nervous,” George Saravelos, the global head of foreign exchange research at Deutsche Bank, wrote in a note on Monday.

Following Moody’s downgrade of the U.S. credit rating on Friday, the rating agency also downgraded the ratings of some of the nation’s largest banks, noting that the government’s downgrade “indicates that its ability to support the U.S.’s global systemically important banks has weakened.”

Anxious investors on Monday also pushed up the price of gold, long a refuge during times of market stress, by about 0.9 percent.

In recent days, analysts at Goldman Sachs and JPMorgan Chase have raised their forecasts for how high U.S. yields will go this year. The analysts said that the pause on the steepest tariffs would help bolster economic growth and also keep inflation running high enough to keep the Federal Reserve from cutting interest rates as soon or as deeply as previously predicted.

Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, said Monday that the Moody’s downgrade would “have implications for the cost of capital and a bunch of other things.” In an appearance on CNBC, Mr. Bostic noted that “there’s a lot of turbulence that’s happening right now.”

Higher rates tend to push up the value of the U.S. dollar, but the currency slid on Monday against the euro, yen and others. That suggested investors may be turning against the United States in general, an echo of the market turmoil last month when spiking yields, falling stocks and a sinking dollar raised questions about the “safe haven” status of U.S. assets.

That episode prompted Mr. Trump to pause so-called reciprocal tariffs, even though he and his advisers had previously dismissed other signs of market unease as they pushed ahead with sweeping tariffs.

The levies have loomed over recent earnings reports from multinational companies. Last week, Walmart said that it would soon begin to raise some of its prices, since it could not “absorb” the full cost of tariffs on the goods it imported. Mr. Trump scolded the retail giant on Saturday, saying in a social media post that it should keep prices down and “EAT THE TARIFFS.”

Walmart’s stock stumbled in early trading on Monday, losing about 2 percent at its lowest point, before recovering to trade slightly down on the day.

Reprinted from the New York Times